What Is a Pip in Forex?

A Simple Beginner-Friendly Guide

A pip is one of the first terms every Forex trader must learn.

It’s the tiny unit that measures price movement and it directly controls how much money you make or lose on every trade.

Let’s walk through it visually and simply.

What Is a Pip?

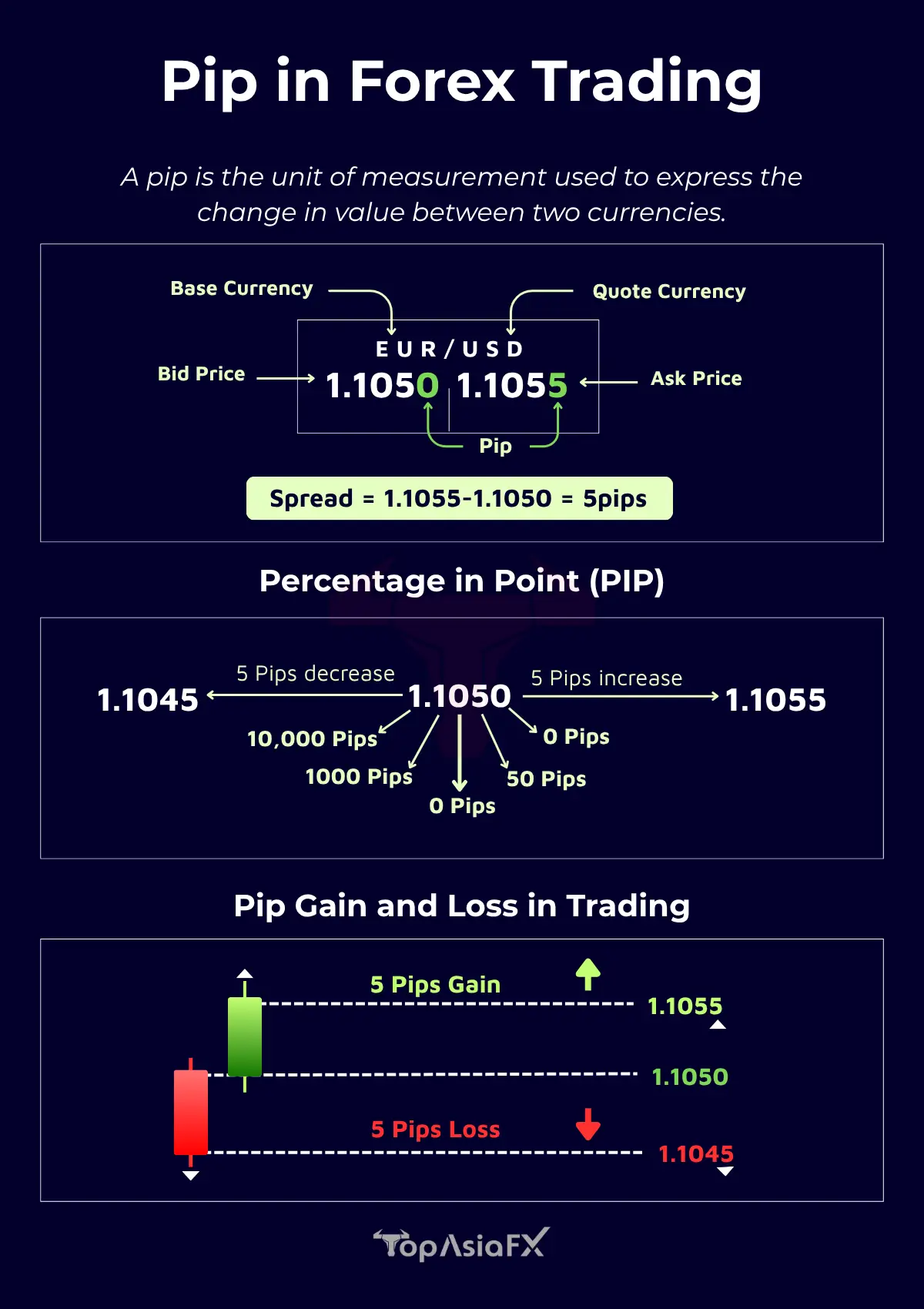

A pip stands for “percentage in point,” and it represents a small movement in price.

👉 For MOST currency pairs

1 pip = 0.0001

👉 For JPY (Japanese yen) pairs

1 pip = 0.01

How Pips Work

Most Pairs (EUR/USD Example)

The pip is the 4th decimal place.

If EUR/USD moves from:

1.1000 → 1.1001

That is 1 pip.

JPY Pairs (EUR/JPY Example)

The pip is the 2nd decimal place.

If EUR/JPY moves from:

140.50 → 140.51

That is 1 pip.

Quick Reference Table

| Pair Type | Pip Location | Example Move | Pip Value |

|---|---|---|---|

| Regular pairs | 4th decimal place | 1.1000 → 1.1001 | 1 pip |

| JPY pairs | 2nd decimal place | 140.50 → 140.51 | 1 pip |

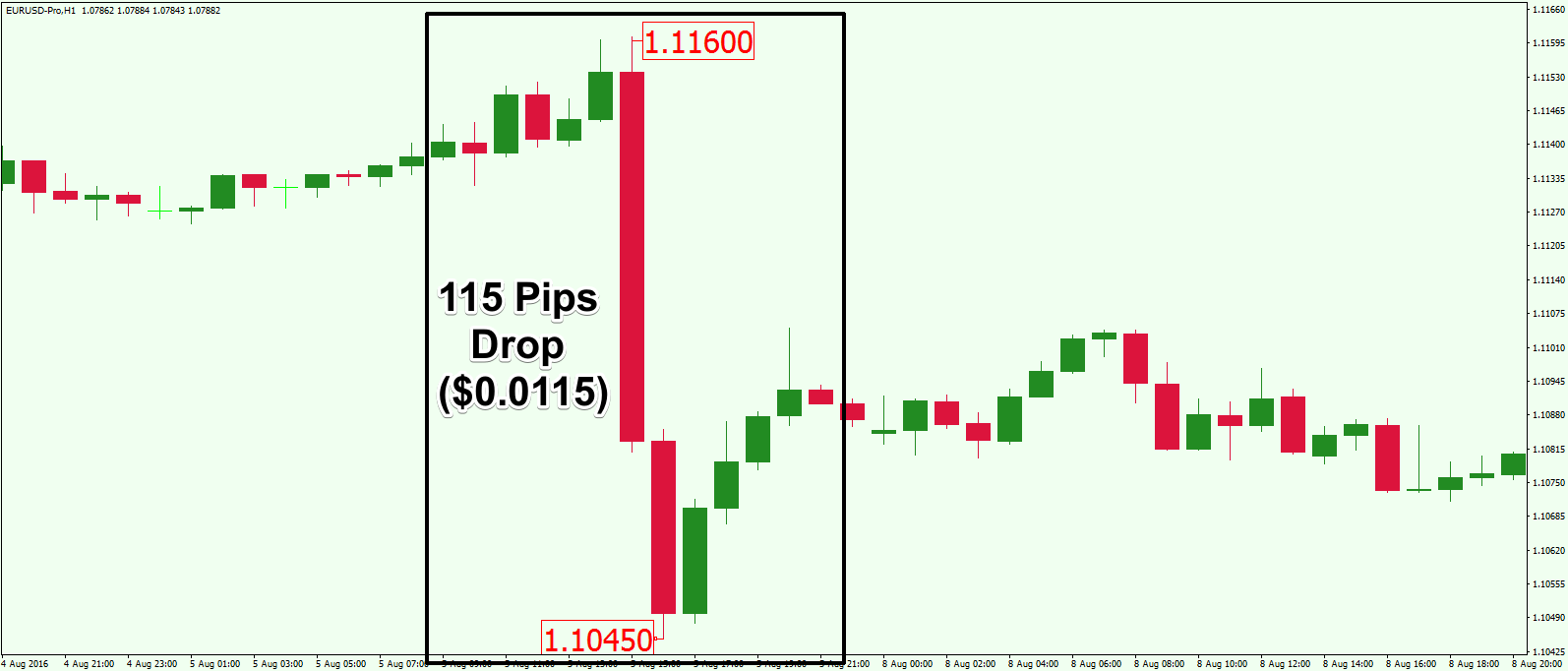

Why Pips Matter: Profit & Loss

Pips tell you how much money you’re making or losing.

A small movement (like 20 pips) can be a small win or a large win depending on your lot size.

Lot Sizes & Pip Values

| Lot Size | Name | Pip Value (Average) |

|---|---|---|

| 1.00 | Standard lot | ~$10 per pip |

| 0.10 | Mini lot | ~$1 per pip |

| 0.01 | Micro lot | ~$0.10 per pip |

⭐ Example: 20-pip move

- Standard lot → $200

- Mini lot → $20

- Micro lot → $2

Same move.

Different risk.

Different results.

Visual Example of Profit Calculation

If EUR/USD moves:

1.1000 → 1.1020 = 20 pips

Trading a mini lot (0.10):

👉 20 pips × $1 per pip = $20 profit

Trading a standard lot (1.00):

👉 20 pips × $10 per pip = $200 profit

Summary

✔ A pip measures price movement

✔ Most pairs = pip at 0.0001

✔ JPY pairs = pip at 0.01

✔ Pip value depends on your lot size

✔ Pips determine profit and loss

Final Thoughts

Understanding pips is one of the most important foundations in Forex trading. Pips tell you how much a currency pair has moved, and they directly determine your profit or loss on every trade. Once you know where to find the pip, how to read it, and how lot size affects its value, you’ll have the confidence to read charts, manage risk, and calculate your trades far more accurately.

Master the basics pips, lot sizes, leverage and the rest of Forex becomes much easier to understand.

Thanks

Stephen V

Watch the YouTube video here

@online.prop.firms