How to Calculate Lot Size in Forex (Beginner-Friendly Guide)

Everything you need to understand lot size, pip value, risk per trade, tools, calculators, and the MT5 EA I personally use.

Why Lot Size Matters (More Than Your Strategy)

Most traders don’t blow their accounts because their strategy is bad – they blow them because their lot size is wrong.

Lot size controls the size of your wins, your losses, and ultimately whether you survive long-term.

Good lot size management equals good risk control.

What Is a Lot Size? (Simple Explanation)

Lot size tells your broker how big your position is.

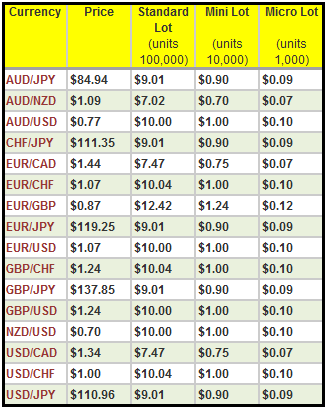

Standard Values

| Lot Size | Value per Pip |

|---|---|

| 1.00 (Standard Lot) | $10 per pip |

| 0.10 (Mini Lot) | $1 per pip |

| 0.01 (Micro Lot) | $0.10 per pip |

If EUR/USD moves 10 pips and you’re trading 1 lot, you win or lose $100.

How Pips & Pip Value Work

A pip is usually the 4th decimal place (0.0001).

Your pip value determines how much money each pip movement equals based on the lot size you’re using.

How to Calculate Lot Size (Core Formula)

Correct lot sizing keeps you safe from oversized losses.

Lot Size = (Account Risk in $) ÷ (Stop Loss in Pips × Pip Value)

Example

• Account: $5,000

• Risk: 1% = $50

• Stop loss: 20 pips

• Pip value: $10 per pip (1 lot)

Lot size = 50 ÷ (20 × 10) = 0.25 lots

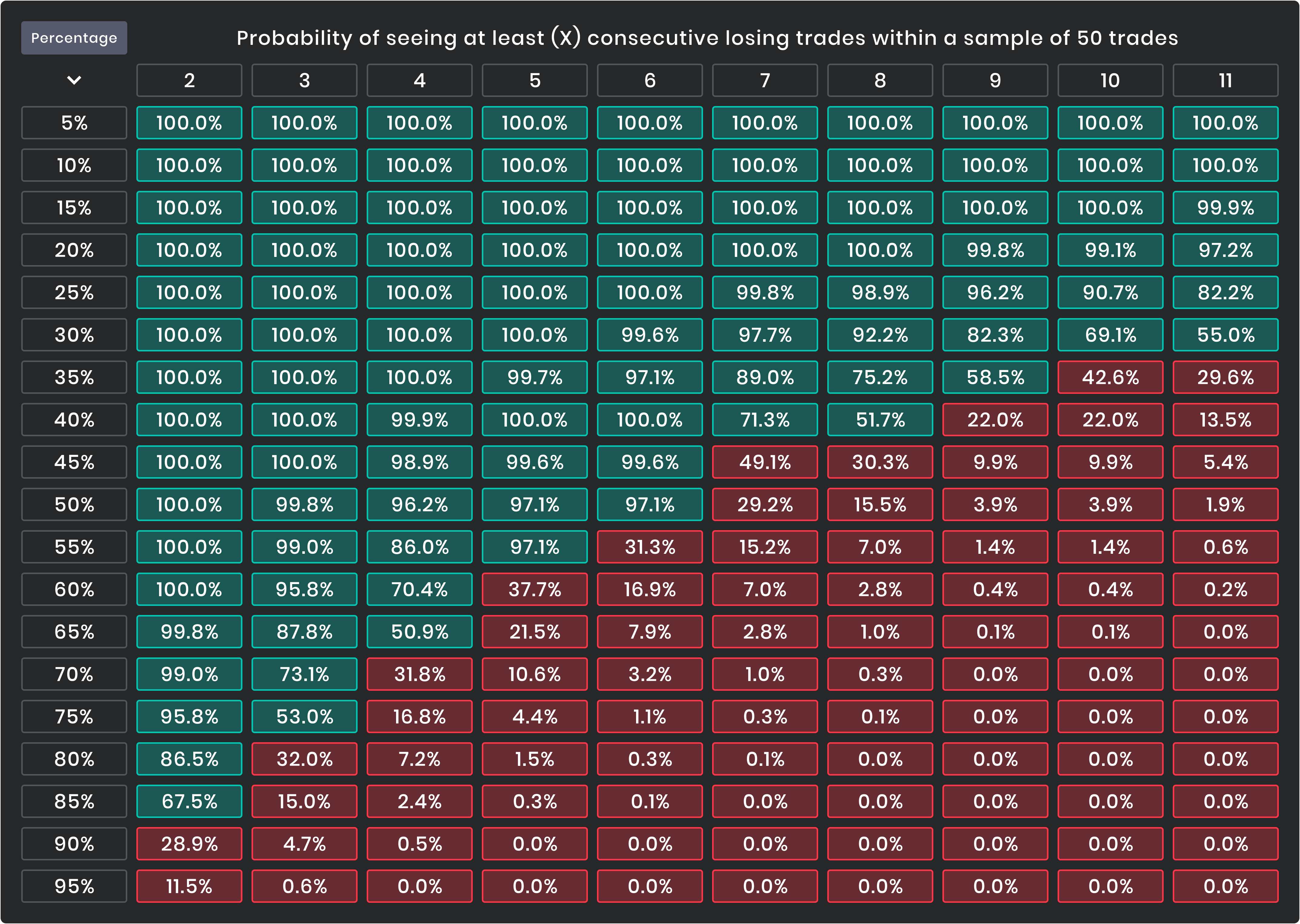

Risk Per Trade: The Real Key to Survival

Managing risk per trade is more important than your trading strategy itself.

Most traders who succeed keep risk between 0.5% – 1% per trade.

Free Tools to Calculate Lot Size Automatically

Here are some excellent free resources covered in your video:

BabyPips Lot Size Calculator

Very beginner friendly.

MyFXBook Position Size Calculator

Provides deeper breakdowns and margin details.

Prop Firm Learning Resources (Highly Recommended)

Free educational hubs are perfect for beginners learning pips, lots, margin, and risk management.

Great options include:

• The5ers Education Hub

• FTMO Academy

• E8 Funding Academy

• FXIFY course modules

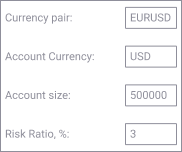

The MT5 Tool I Personally Use (EarnForex Position Size Calculator EA)

This EA calculates your position size automatically based on your stop loss placement and chosen risk.

Just drag:

• Entry

• Stop loss

• Take profit

Type in your risk amount → EA calculates the exact lot size instantly.

Beginner Mistakes to Avoid

The most common mistakes:

- Using fixed lot sizes instead of calculated risk.

- Risking too much per trade (3–10% is common…and deadly).

- Ignoring calculators and guessing lot size.

- Violating prop firm daily loss limits.

Putting It All Together (Quick Recap)

• Master lot size → master risk → survive long enough for your strategy to work.

• Use calculators (BabyPips, MyFXBook).

• Use tools (EarnForex EA).

• Risk small, stay consistent.

Trading isn’t about chasing big wins — it’s about protecting your account until those wins naturally come.

Final Tips

• Stick to 0.5–1% risk per trade

• Let tools do the math

• Keep lot sizes consistent

• Focus on risk management over entries

Thanks

Stephen V

Watch the YouTube video here

@online.prop.firms