TSG Broker Review: Platforms, Account Types, Fees & Trading Features Explained

Choosing the right broker can be difficult, especially with so many platforms claiming tight spreads, low fees, and advanced tools. In this review, we take a detailed look at TSG Brokers, covering their account types, trading platforms, available assets, and standout features based on a full hands-on walkthrough.

This article is not financial advice — it’s a practical overview of how the broker works and what traders can expect.

Overview of TSG Brokers

TSG Brokers is an STP (Straight Through Processing) broker offering access to a wide range of markets, including forex, stocks, indices, commodities, and cryptocurrencies. The broker promotes transparent trading conditions, competitive spreads, and professional-grade tools for traders at different experience levels.

According to the company’s website, TSG Brokers is owned and operated by TSG Brokers Limited and is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), which is an important consideration for traders focused on regulation and security.

Account Types and Minimum Deposits

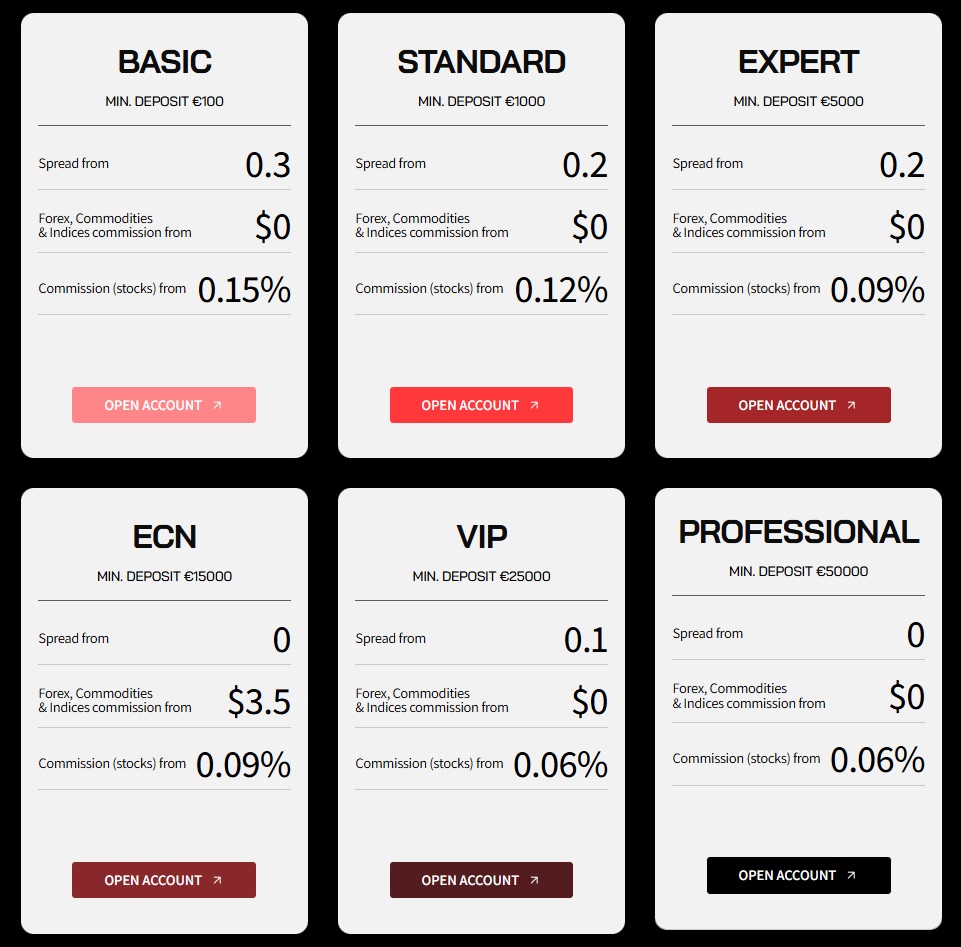

TSG Brokers offers six different account levels, designed to suit both smaller retail traders and higher-volume traders.

Account Levels Breakdown

-

Basic Account

Minimum deposit: €100

Spreads from 0.3 pips

Stock commissions from 0.15% -

Standard Account

Minimum deposit: €1,000

Spreads from 0.2 pips

Stock commissions from 0.12% -

Expert Account

Minimum deposit: €5,000

Spreads from 0.2 pips

Reduced stock commissions from 0.09% -

ECN Account

Minimum deposit: €15,000

Spreads from 0.0 pips

Stock commissions from 0.09% -

VIP Account

Minimum deposit: €25,000

Spreads from 0.1 pips

Stock commissions from 0.06% -

Professional Account

Minimum deposit: €50,000

Spreads from 0.0 pips

Stock commissions from 0.06%

This tiered structure allows traders to start small and unlock better pricing as their capital increases.

Trading Platforms: MT5 & TSG Web Platform

TSG Brokers offers two trading platforms:

-

MetaTrader 5 (MT5) – a widely used platform known for advanced charting, indicators, and automated trading.

-

TSG Web Platform – a browser-based platform with a clean interface and built-in tools.

Standout Platform Features

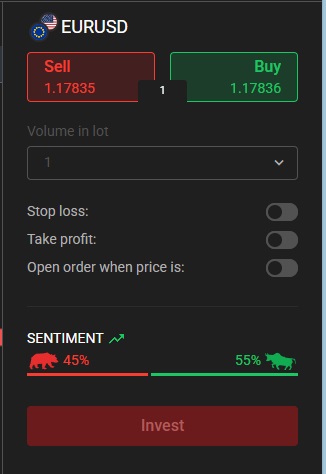

One of the most notable features on the TSG Web Platform is the market sentiment indicator, which shows the percentage of traders currently buying or selling a specific asset. This is displayed clearly alongside charts and asset information.

Other useful features include:

-

Light and dark mode options

-

Easy switching between assets

-

Clear display of leverage, swaps, and commissions

-

Built-in risk and reward calculation before placing trades

The platform also allows traders to create a favourites list, making it easier to track commonly traded instruments across different asset classes.

Tradable Markets and Assets

TSG Brokers offers access to over 300 instruments, including:

-

Forex – Major, minor, and exotic currency pairs

-

Indices – Global indices such as the German 40 and Japanese indices

-

Commodities – Gold, silver, and other commodities

-

Stocks – Individual shares such as Apple

-

Cryptocurrencies – Bitcoin, Ethereum, and other popular digital assets

Leverage levels vary depending on the asset class, with lower leverage applied to higher-risk instruments such as cryptocurrencies.

Education and Research Tools

For traders looking to improve their knowledge, TSG Brokers provides:

-

An economic calendar for tracking market-moving events

-

An FX glossary explaining common trading terms and indicators

-

A regularly updated blog, covering topics such as STP trading, ECN vs STP, and beginner trading guides

These tools are useful for newer traders who want to understand terminology and market structure before placing trades.

Regulation, Security & Support

TSG Brokers states that it is authorised and regulated by CySEC, which adds a layer of credibility and oversight. The broker also provides multiple customer support options, including email, phone support, and an online contact form.

As always, traders should independently verify regulatory information and ensure a broker fits their personal risk tolerance.

Final Thoughts: Is TSG Brokers Worth Considering?

TSG Brokers offers a broad range of assets, multiple account tiers, and a user-friendly web platform with useful sentiment and risk tools. The low minimum deposit makes it accessible for beginners, while tighter spreads and lower commissions may appeal to more experienced traders.

That said, every trader’s needs are different. It’s important to compare brokers, understand the fee structure, and trade with proper risk management.

If you’re exploring new brokers, TSG Brokers may be worth adding to your comparison list.

Thanks

Stephen V

TSG Brokers… https://tsgbrokers.com/

The 5ers = 10% off new accounts… http://www.the5ers.com?afmc=xvc

FundedNext = 10% off accounts… https://fundednext.com/?fpr=stephen18

Watch the YouTube video here

🔎 TSG Brokers Review – Quick Summary

Broker Name: TSG Brokers

Broker Type: STP (Straight Through Processing)

Regulation: CySEC (Cyprus Securities and Exchange Commission)

Minimum Deposit: €100

Tradable Assets: Forex, stocks, indices, commodities, cryptocurrencies

Number of Instruments: 300+

Trading Platforms: MetaTrader 5 (MT5), TSG Web Platform

Spreads: From 0.0 pips (ECN & Professional accounts)

Stock Commissions: From 0.06% (VIP & Professional accounts)

Leverage: Varies by asset (up to 1:100 on forex)

Notable Features:

• Built-in market sentiment indicator

• Risk & reward calculation before trade execution

• Light & dark mode web platform

• Favourites list for quick asset access

Best For:

✔️ Beginners starting with small capital

✔️ Traders who value transparent pricing

✔️ Traders who like built-in sentiment tools

Not Ideal For:

✖️ Traders looking for ultra-high leverage

✖️ Traders who prefer mobile-only platforms

@online.prop.firms

Our Instagram: https://www.instagram.com/onlinepropfirms

https://www.instagram.com/onlinepropfirms/

https://www.instagram.com/onlinepropfirms/reels/