FTMO vs The5ers: A Comprehensive Comparison of the Top Prop Firms

In today’s post, we’re diving into the world of proprietary trading firms, focusing on two of the biggest names in the game: FTMO and The5ers. We’ll be comparing their $100k challenges, examining the rules, payouts, and scaling plans to help you decide which firm is the best fit for your trading style.

Phase 1 and Phase 2 Challenges

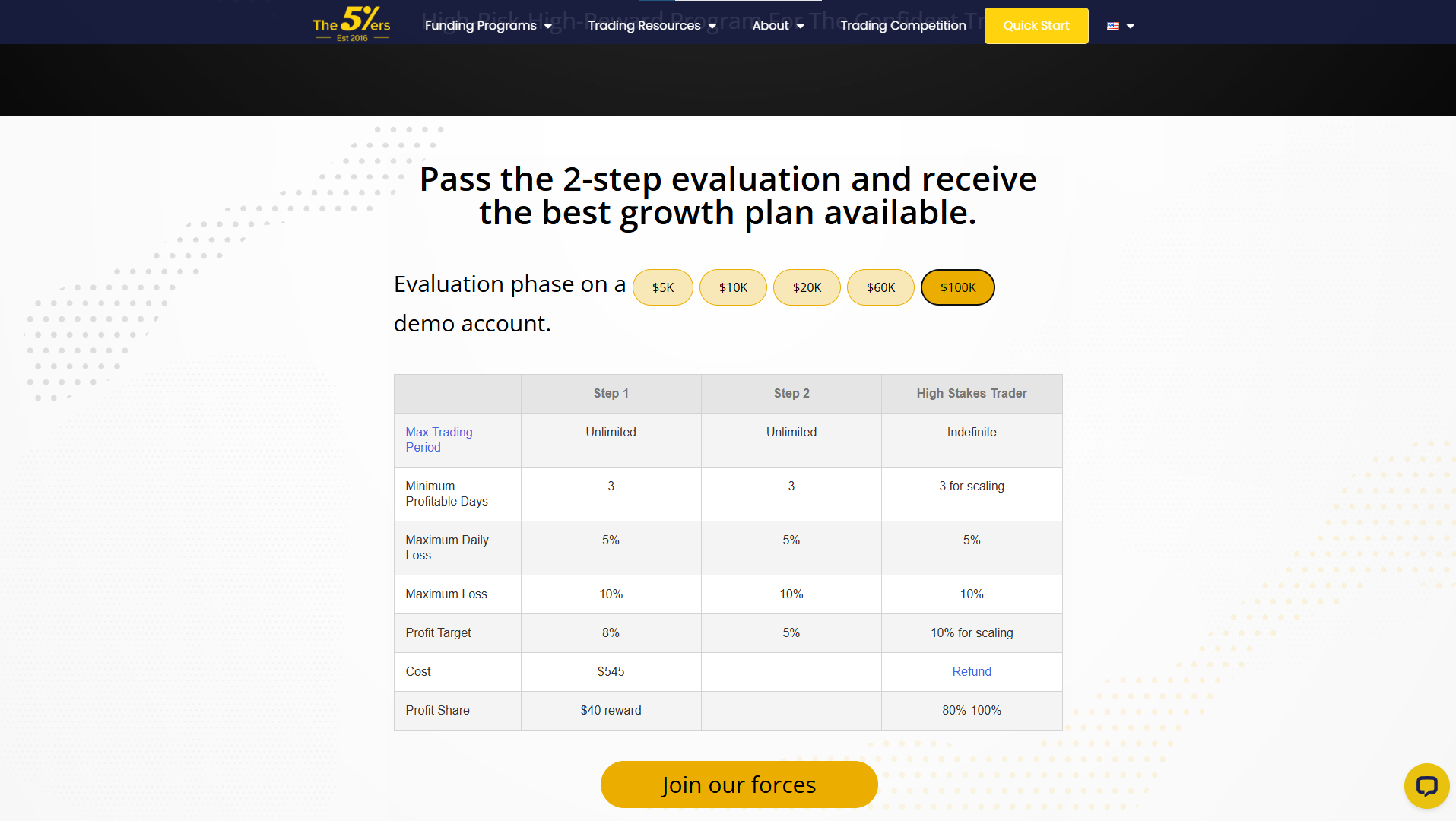

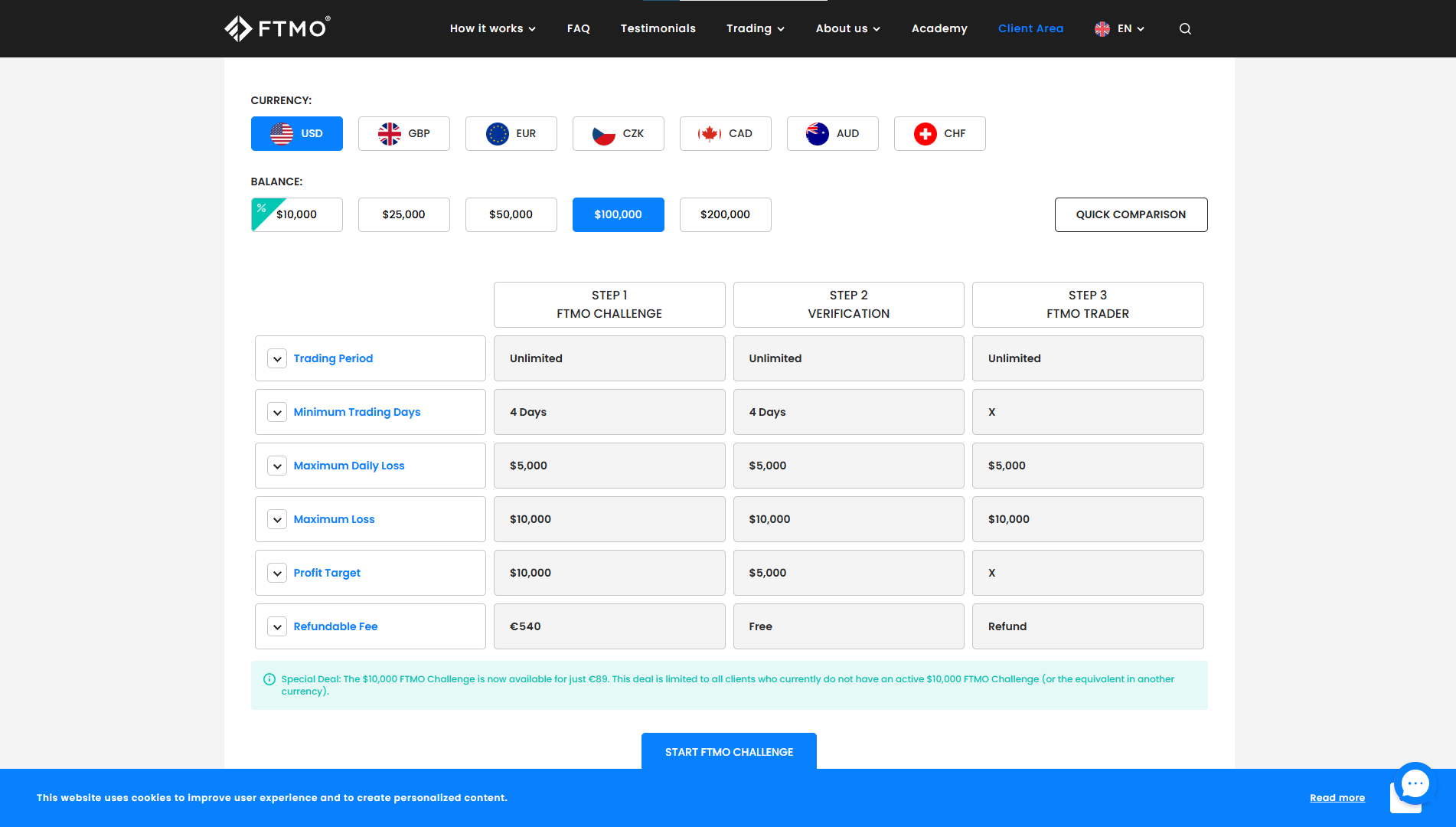

Both FTMO and The5ers use a two-phase evaluation process. The key difference here is that FTMO requires a 10% profit in Phase 1, whereas The5ers only requires 8%. Both firms require a 5% profit in Phase 2, with a maximum drawdown limit of 10% and a daily drawdown limit of 5%.

Challenge Rules

| Feature | FTMO | The 5ers |

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Max Daily Loss | 5% | 5% |

| Max Overall Loss | 10% | 10% |

| Minimum Trading Days | 4 | 3 |

* The 5ers offer a slightly easier entry with only an 8% profit target in Phase 1 (compared to FTMO’s 10%).

Pricing and Account Types

When comparing the prices, FTMO falls behind, with their $100k account priced at $638, compared to The5ers’ $545. FTMO offers two types of accounts: the standard account with a leverage of 1:100 and no news trading, and the swing account with a leverage of 1:30, which allows you to hold positions over weekends and during news events. This matches The5ers’ high-stakes account.

Cost of Entry

- FTMO: $638 (€540) for a $100K challenge

- The 5ers: $545 for a $100K challenge

Both fees are refundable once you pass the challenge, but The5ers comes in nearly $100 cheaper.

Trading Platforms

FTMO has an edge when it comes to trading platforms, offering a choice between MT4, MT5, cTrader, and DX Trader. In contrast, The5ers currently only supports MT5. If you have a preference for a particular platform, this might be a deciding factor for you.

Here’s where FTMO shines:

- FTMO: Offers MT4, MT5, cTrader, and DX Trader

- The5ers: Currently only MT5

Payouts and Profit Splits

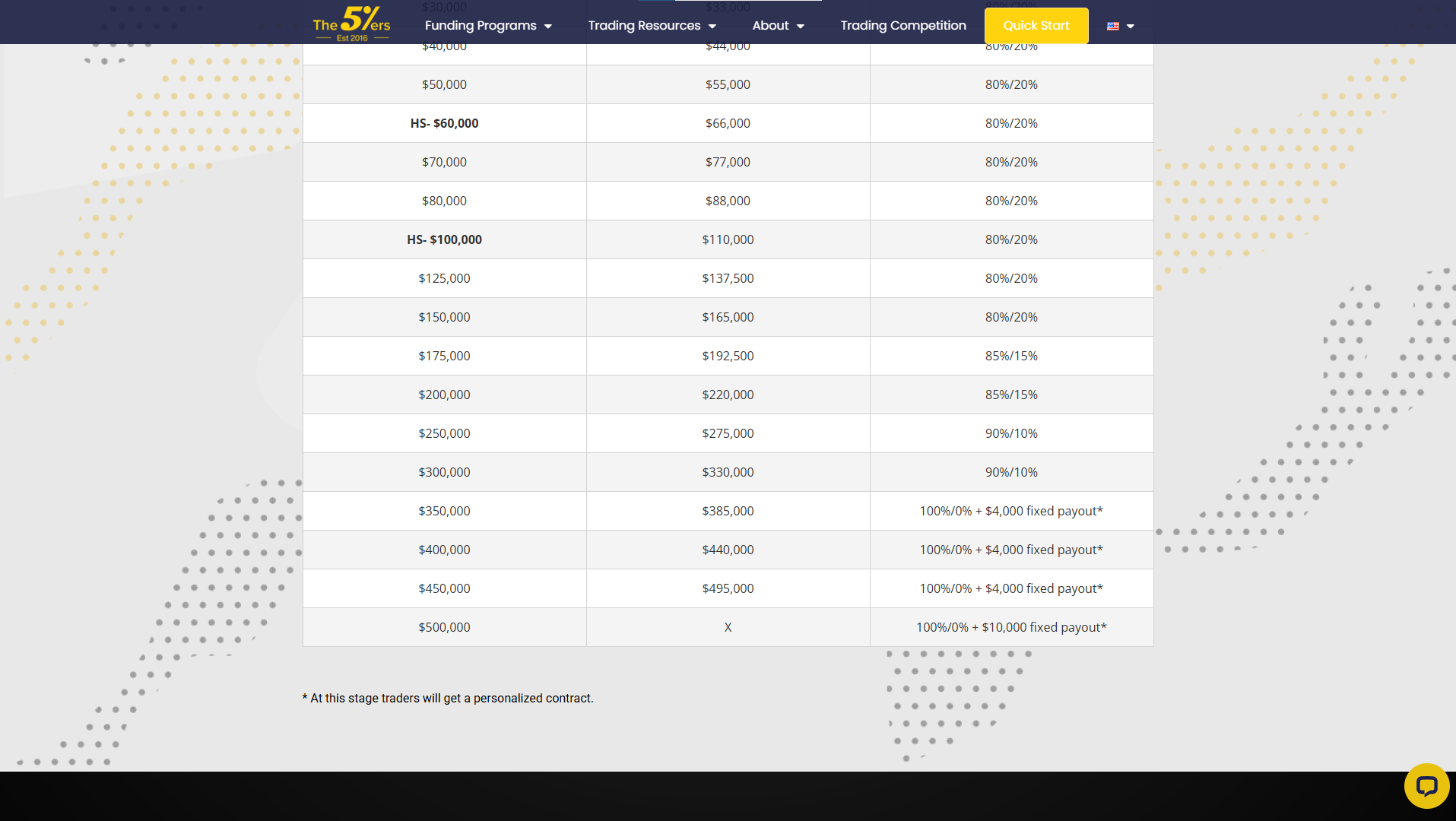

Both firms offer 14-day payouts once funded. FTMO has an advantage here with a 90% profit split right from the start, whereas The5ers starts at 80% but allows you to work your way up to a 100% profit split as the account scales.

Scaling Plans

The scaling plans are where the two firms differ significantly. FTMO offers a 25% account growth every four months, up to a maximum of $400,000, provided you are consistent.

The5ers, on the other hand, has a simpler system where your account increases by 10% every time you make a 10% profit, up to a maximum of $500,000. This makes The5ers the better choice if you’re solely looking at scaling plans.

Other Key Features

- Both allow overnight and weekend trading (with swing accounts).

- Both allow news trading, but The5ers restricts entry within 2 minutes of high-impact news.

- Both refund your challenge fee once funded.

Conclusion

In summary, both FTMO and The5ers are excellent choices in the prop trading scene. FTMO requires a higher profit in Phase 1 and is slightly more expensive, but offers more trading platform options, and a higher initial profit split.

The5ers, while cheaper and with a simpler scaling plan, starts with a lower profit split. Ultimately, the choice between the two will depend on your specific needs and trading style.

Which one would you choose? Let us know in the comments below. Thanks for reading, and we’ll catch you next time!

Thanks

Stephen V

Watch the YouTube video here

@online.prop.firms